The trade credit control is one of the basic functionalities in the sales process. It is of strategic importance from a business point of view. This prevents situations in which additional goods or services would be delivered to customers who default on payments above the agreed limit. The credit control allows the company to avoid problems with liquidity or even significant losses if the customer turns out to be insolvent (an exceeded credit limit may mean that our partner has financial problems).

On the other hand, the trade credit control has also an impact on building relationships with the customer. A refusal to supply goods or services due to a slightly exceeded limit can spoil these relationships. Therefore, it is important that the data used as a basis for the control of the credit use be accurate and reliable.

How does it work in SAP?

To put it simply, the rule of trade credit operation in SAP can be described in the following steps:

- for a specific partner (payer) the maximum amount of the credit agreed with a given partner during the trade negotiations is entered;

- when SD documents are being processed, the system checks whether for a given partner the balance of the trade credit granted has not been exceeded;

- if the customer exceeds the limit of the credit granted, the system may block further processing of the relevant sales (credit blocking);

- an authorized user can release a given sales process for further processing.

The use of the credit limit by a given payer consists of the following values:

- open sales orders – new sales documents for which no deliveries have been created yet;

- open deliveries – new deliveries for which no invoices have been created yet;

- open invoices – new invoices for which no accounting documents have been created yet;

- open FI items – postings of receivables in the FI module for which a clearing item remains open (a remaining open clearing amount is important).

In the working SAP system, a lot of open sales processes for a given payer can be simultaneously processed. It would be time-consuming to calculate the above-mentioned values in each single case, which is why the system does not calculate them each time anew. Instead, values of the credit used are kept in an aggregated form. They are updated whenever you save an SD document (only the value of open FI items is calculated on an ongoing basis).

When a sales order is created, the value of the order increases the amount of the credit used in the “open orders” item. Each time the sales order is edited, the “open orders" value is updated in such a way that the value of the order is subtracted before the user changes, and it is added after the changes.

When created with reference to a delivery order, the “open orders” item is decreased, and its value increases the “open deliveries” item. Similarly, in delivery invoicing, the “open deliveries" item is decreased, and the “open invoices” item is increased, which in turn is decreased after the creation of an accounting document. Then, the value of an open clearing item is transferred to the FI module, where it is waiting for settlement. This process is shown in the table below.

| Event | Open orders | Open deliveries | Open invoices | Open FI items |

| Sales order | + | |||

| Delivery | – | + | ||

| Invoice | – | + | ||

| FI document for invoice | – | + | ||

| Payment (FI item clearing) | – |

More “technically”

As part of the functionalities supporting logistics processes in SAP, the so-called Logistics Information System is provided. Its part is dedicated to the SD process; it is called SIS – Sales Information System.

In a nutshell, this mechanism is based on:

- the so-called information structures, i.e. tables where aggregate sales values (e.g. the value of sales of a specific group of materials broken down by accounting months) are stored. One of the standard structures is dedicated to support the credit control functionality – it contains the value of open orders, deliveries and invoices for a specific payer within the credit control area;

- programs that are automatically started when SD documents are saved. These programs update values in the information structures. It is good to know that they do not start immediately when an SD document is saved, but later, with a lower priority so that time-consuming processing of the information structures does not interfere with the ongoing work of users.

What may go wrong?

SIS is a functionality that is very sensitive to configuration or technical problems appearing in the system.

Typical reasons of errors are:

- configuration changes regarding the credit control (determination of the credit control area or risk class, assignment of document types to credit control, changes in partner master data affecting the way in which credit control is carried out). Each time such changes are introduced into the production system, it is necessary to re-generate information structures;

- not responding programs updating information structures (the so-called update task V2). It is necessary to keep track of whether SIS updates are running properly. If not, you have to try to repeat them or re-generate information structures;

- Errors in extensions – each time the saving of an SD document is started, values in the information structure are updated; SD programs are so designed that they contain internal tables with data before and after the user changes. The “old" values update the information structure with a minus sign, and the new one – with plus. If the extension modifies the values in these internal tables in a wrong way, the information structure may be updated incorrectly.

Then what?

Unfortunately, the system does not have a built-in security measure that detects the case in which the values in the information structure are incorrect. Inconsistencies are usually identified by the user who encounters locked sales processes when serving a customer.

What is worse, the standard SAP functionality shows aggregated values only. Verification of their correctness is very complicated and can be very time-consuming (searching for open orders, deliveries, invoices and their analysis).

If an error is identified, the only solution is to rebuild the information structure using a standard recovery program (which means the deletion of entries in the information structure and recalculation of its value).

All for One Credit Controller

In order to support employees responsible for sales and settlements with customers in verifying the operation of the credit control functionality, BCC has developed a proprietary tool – All for One Credit Controller, which:

- allows you to compare the values in the communication structure with the amounts calculated on the basis of documents (verification of the correctness of entries in the information structure);

- in the case of inconsistencies – displays a list of open orders, open deliveries, not posted invoices and open FI items that make up the value of the credit used.

A controller’s cockpit provided to users allows you to display a list of individual items of open SD and FI documents. All for One Credit Controller is a kind of a multi-transaction tool known from SAP solutions. Its operation is easy and intuitive and can be done using standard actions regarding data selection, reporting, viewing details, screens and subscreens.

Data selection

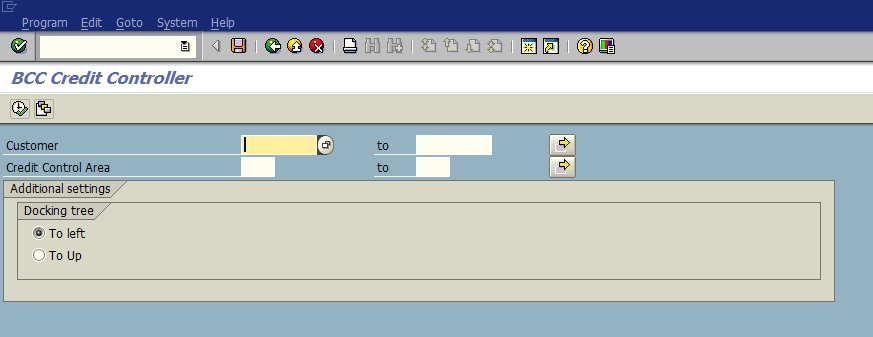

The data selection is made on the basis of a credit control area or by payer.

In All for One Credit Controller, the data selection is made on the basis of a credit control area or by payer.

Work area

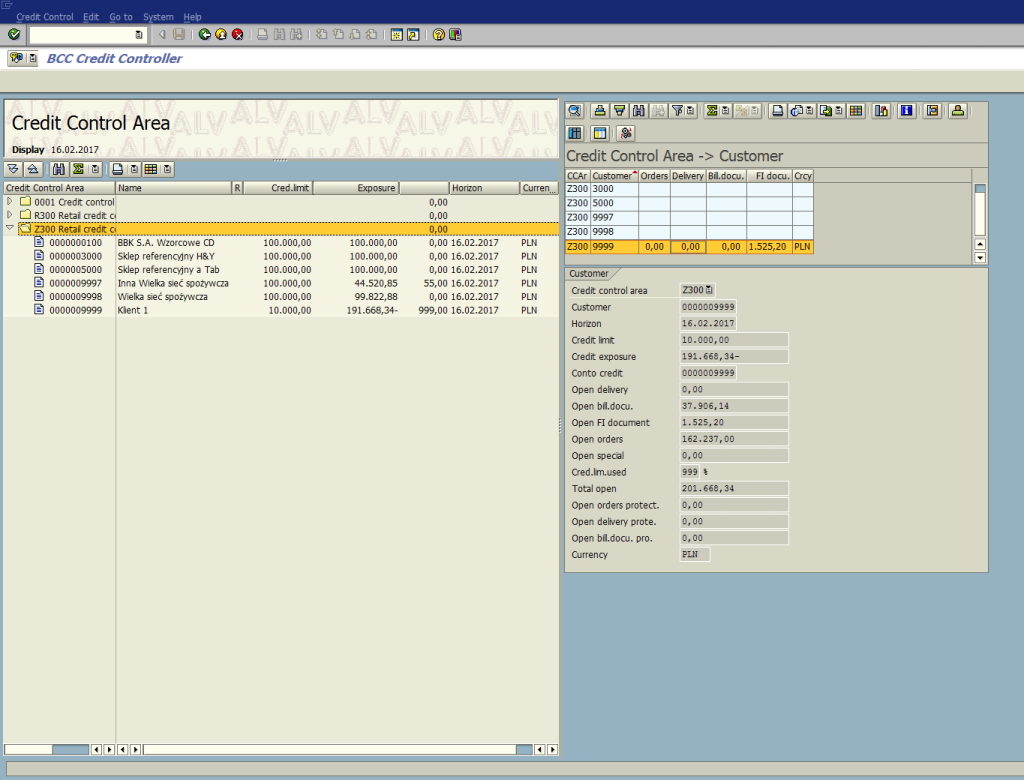

The main work area has been organized in the form of three areas and dialog windows as well as additional screens to display a list of documents. After it is started, it displays master data according to the configuration of credit control areas, and aggregate data of individual payers in the area.

Analysis

The proper analysis starts after double-clicking the payer’s items in a tree or a credit control area node.

The examination is carried out for individual payers, using the SD document flow and the data of individual items for documents of orders, deliveries, invoices, and accounting documents.

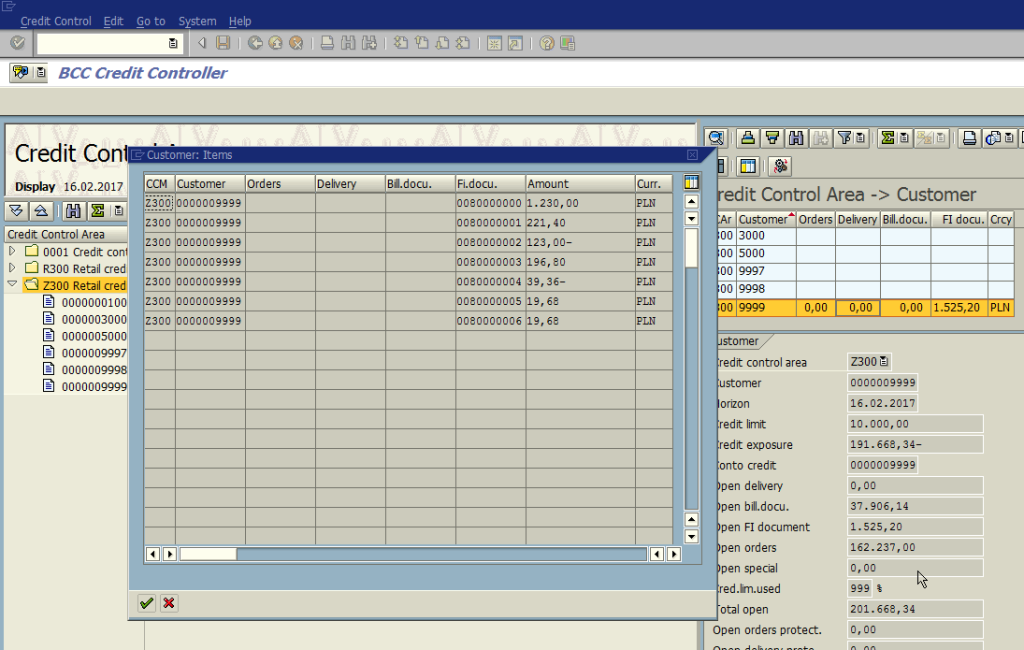

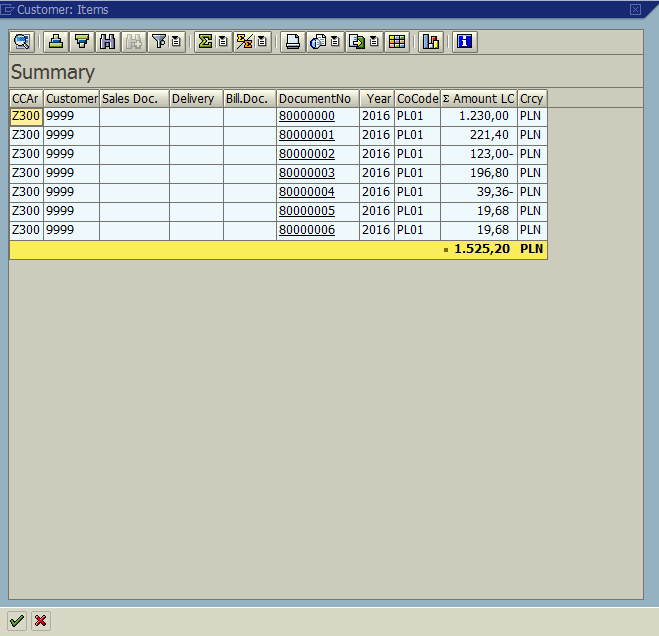

The top area shows the aggregate result of the analysis of payers by area. The analysis allows you to display a list of open items of documents with amounts.

The list of results displayed enables sorting, aggregating and saving to a PC file as well as navigating to documents via active links.

Credit data integrity

The proprietary solution All for One Credit Controller helps you identify the items of documents which can cause a loss of the payer’s liquidity for the sales process. It can help prevent situations in which additional goods or services would be delivered to customers who default on payments above the agreed credit limit, which could mean the problems with liquidity or even serious losses for the company. It enables the integrity of credit data to be maintained.

The work area displays master data according to the configuration of credit control areas, and aggregated data of individual payers in the area. The analysis starts after double-clicking the payer’s items in a tree or a credit control area node.

Displaying details – a list of open items of documents with amounts.

The list of results enables sorting, aggregating and saving to a PC file as well as navigating to documents via active links.